La Mirada Blog

Articles by Noel Jaimes

Is La Mirada Now a Divided City?

Forty years ago, I began my career as a realtor in La Mirada. A home was about $53,000. Today, they’re around $500,000. Life is about change. Change is inevitable and our City Council election on March 7, 2017 is no exception.

In the past, candidates had to appeal to the entire city to get elected. I know, because I go way back to the days of Lou Piltz. Where church retreats, the Kiwanis Club, Little League games along with Easter Egg Hunts and festivals, was the way to show your commitment to our city.

But this past summer the Mexican-American Legal Defense Education Fund (M.A.L.D.E.F) threatened the city with a major lawsuit, if they didn't create a Latino District. The way state law was written our Council had no choice but to comply.

The result is La Mirada has five new Council Districts. Districts 1 and 2 will be up for election in March. The Latino District is #1 and despite District #2 having a healthy 41% Latino population, no Latino chose to run.

MALDEF had claimed a plethora of complaints by Latinos that no Latino could win a City Council seat in La Mirada. MALDEF’s problem is that our current Mayor Steve DeRuse is Latino! MALDEF’s goal was to only elect Latinos and they failed.

So there it is in a nut shell. Council seat #1, might elect a Latina and Council seat #2, has no Latino candidate.

Finally, please vote on March 7, 2017.

MAY REAL ESTATE REPORT: Low Inventory of Homes for Sale in La Mirada

REAL ESTATE

Looking at the last three years, 494 homes sold in 2012, 424 sold in 2011 and 439 sold in 2010.

Prior to the financial melt down that lead to this recession, one could expect an average of 610 properties selling each year to new home owners-about 50 homes sold per month.

Today, we are down to 35 homes per month.

We have a tad over 15,000 homes in the city. With the exception of the Hillsborough homes on the East side of town. Most homes were built in the late 50’s and early 60’s.

I want to share this basic information about the city housing units because unlike the media that is basically ignoring and/or trying to put a positive spin on the National and Southern California real estate market, the reality is that the old real estate adage “Location, Location and Location” is still the best base-line to determine what is happening to property values.

The Median household income in La Mirada is about $83,000, while the State’s median income is just under $59,000 dollars. I mention this because in reviewing the foreclosure activity for this report, I discovered that there are more foreclosures in the Hillsborough part of town than in the Foster Park area where the average median income level is much lower.

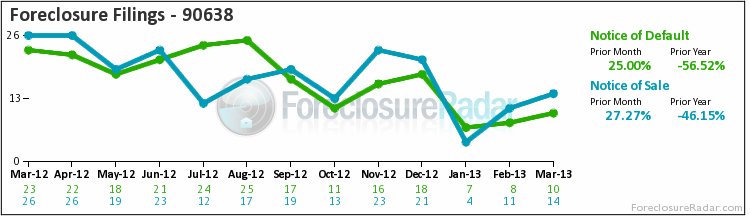

Since the beginning of the year, a full 28% of La Mirada homes have been sold due to a financial crisis (foreclosure). It is interesting to note that the Hillsborough area has seen more foreclosures than the Foster Park area.

Currently there are 93 properties in some stage of the foreclosure process. Again, Hillsborough leads the foreclosure activity with 14 foreclosures compared to the Foster Park area with only 10 Foreclosures. This should easily reveal to all residents that the economic recession is hitting the high income earners as well.

The most expensive property so far to be closed in La Mirada is on Placid Dr., which sold at a foreclosure auction on March 28, 2013 for $1,108,622 dollars.

Finally, 73 properties are pending sales in La Mirada and 20 properties have been canceled.

That’s the big picture for all of us to see. Now what does that mean to the individual home owner?

It means that the inventory of homes for sale in La Mirada is at an all time low!

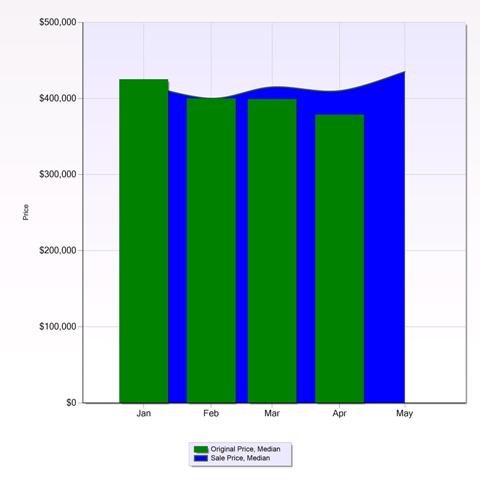

As you can see from the chart, the blue line is rising and the green bar is falling. You can also see by the slope of the blue line that the gap is increasing quickly and we may have a mini-boom in property values this summer. But it will not be due to any economic recovery. It will be due to the lack of inventory of homes to sell in the city.

Banks continue to hold their REO (Real Estate Owned) inventories in their pockets or are selling them to long term investors to hold for at lest three years. La Mirada home ownership used to be over 87% it’s now down to 79% with many homes renting for over $1600/month.

How long this will go on is anyone’s guess.

REAL ESTATE: Though the Housing Market has Improved, Families Still Struggle in La Mirada

REAL ESTATE

Dear La Mirada Homeowner,

My name is Noel Jaimes, and I have called the City of La Mirada my home since 1975. I will be writing a weekly column here about La Mirada real estate in hopes of giving residents a general overview of what is happening in the real estate market each week.

I began my career in real estate when I was a student at Biola College, now Biola University. It is funny how 38 years later I still consider myself a tentmaker. Helping people buy their first home was an exciting job. Before the big financial crash of the last decade, people worked very hard and long to save 10 to 20 percent for a down payment.

I remember buying my first home after getting married and then worring about making the $690 mortgage payments. Yes, I did say $690 a monthly mortgage payments. You may be smiling and wishing that this was your current mortgage payment. But the reality is it’s a matter of perspective.

When we moved into our home there was a wonderful elderly couple living at the adjacent corner of where we lived. His name was Leonard. I can’t remember his wife’s name right now. Anyway, when I shared with him how hard it was to come up with $690 a month. He just smiled and told me that it would…. “get better.”

Of course I doubted him and he could tell by the look on my face that I did not believe him.

Leonard then proceeded to tell me how after returning from France after World War II, he bought his home on Gabbett Drive for only $7,200-brand new. His payments were $72 a month and back then he was worried, wondering how they were going to make it as newlyweds.

At the time of this conversation with Leonard I was just 27 years old, just graduated from Biola College, was working part time in real estate and full time at Ralph Grocery Company and was not able to fully swallow this tall tale by a man who is my senior by at least 50 years. So guess what Leonard did?

First, he invited me to his home. Once I was there, he walked over to a cover drawer where he removed a small box. I thought he was going to get his reading glasses. But instead he opened the box and handed me something that completely shocked me.

Recent posts